What we do – short version

Strategic asset allocation over the long-term (saalt) has been developed to translate the best available economic-financial modeling into a guiding framework for actionable asset allocation and financial planning.

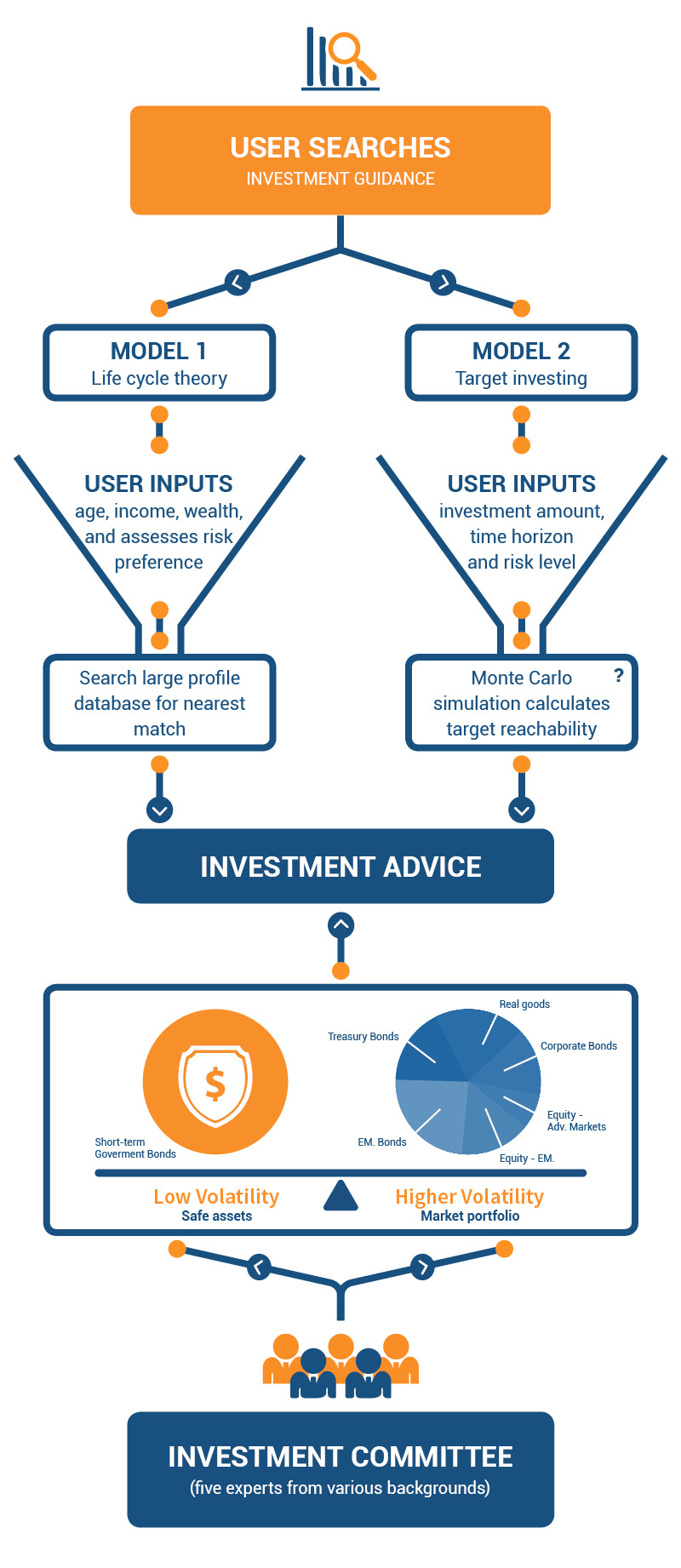

What investment framework is right for you?

Model 1

Model 1 tailors a portfolio composition to your personal and wealth characteristics.

- Tailoring is based on life-cycle theory. It calculates the appropriate amount of saving over your working life, allowing smooth consumption over the life cycle, including retirement. Your portfolio risk allocation is also determined by your personal circumstances.

- Benchmark your current behavior against a model optimum and check the sustainability of your financial decisions.

- A large database of computer generated profiles is searched to find the nearest match.

Model 2

Modell 2 does not require personal or wealth characteristics, you set all necessary parameters.

- Chose a risk level you feel comfortable with and set the investment horizon you have in mind.

- A Monte Carlo simulation allows you to check the probability of reaching your specified target.

The investment advice

The investment advice framework is a hybrid – put together from a tailored computer risk allocation, and a human/expert Investment Committee (IC). The IC is in charge of setting the weights within the market portfolio.

The market portfolio

The market portfolio is created in a two-step approach: First, an empirical estimation is made of the latest “global market portfolio” (GMP), which is defined as the weighted sum of every traded asset in the world. Second, within a Black-Littermann framework both the implied current market return of every asset will be determined and the return expectations of all IC members will then set SAALT’s final GMP weights.

The Investment Committee

The Investment Committee is formed of five finance experts. Their expertise is either derived from research in the fields of theoretical and empirical finance or from experience in international financial institutions. Their meetings take place twice a year, when they decide on the weighting of the global market portfolio.